TRANSPARENCY AND EXPERTISE

Why Brownstone?

Brownstone Development Group is primarily a basis buyer. We focus on value-add assets with below-market rents, poor management, and capex needs. We believe best to buy on basis and sell on cap rate if possible. For storage opportunities, there will be particular focus on additional land for expansion or outparcels, leveraging our development and adaptive re-use ability.

Brownstone leverages extensive and deep-rooted relationships with owners, brokers, lenders, mortgage brokers, and management companies to find both marketed and off-market opportunities. Many of our principals are current and past brokers and have extensive long-term relationships. Our track record of closing 100% of deals under PSA provides comfort to sellers in both scenarios.

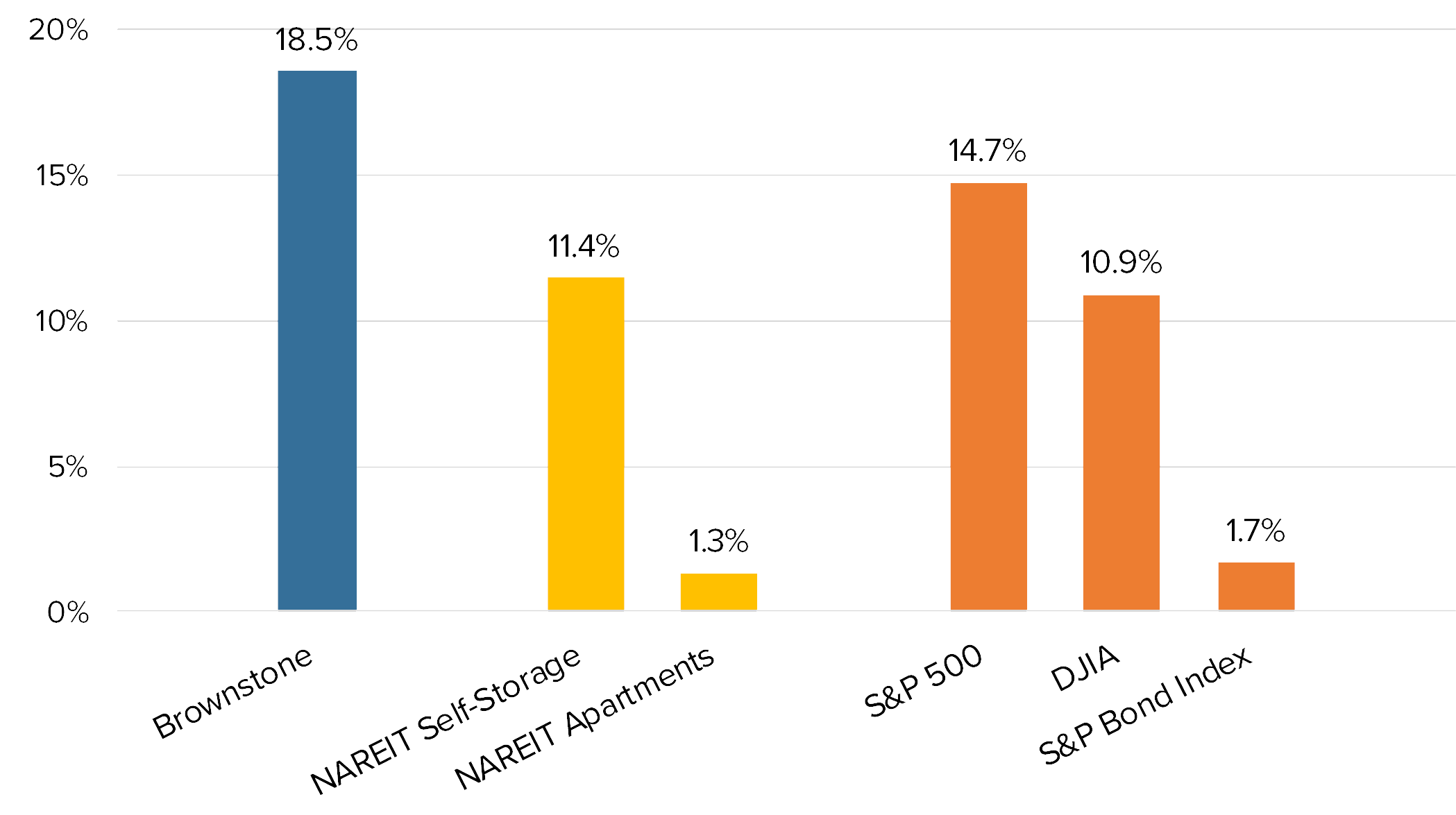

5-Year Average Returns*

* Sources: S&P 500 and DJIA – spglobal.com 5-Year Total Return as of 4/02/24. This metric captures both the price movement of the index’s components and the income they generate, taking into account both dividends and price appreciation. S&P Bond Index – spglobal.com 5-Year Rturn as of 4/02/24. NAREIT – reit.com 5-Year Compound Annual Total Returns (Domestic) as of 4/02/24.

Highlights

Attractive Returns

We aim to provide our investors with IRR ranging from 15%-18% and a total equity multiple of 2.0-2.3X in just 2-5 years. But in many of our investments we have far surpassed our targets.

Strategic Investment Decisions

We strategically choose real estate investment opportunities in high-growth markets such as Georgia and Texas to maximize returns. Growth is central to our ethos. We pursue properties with high appreciation potential and enhance value through strategic improvements, aiming for both immediate income and long-term gain. Our approach is guided by thorough market analysis to spot trends and opportunities.

Proven Strategies

Our experienced team at Brownstone Development Group uses several proven strategies to provide attractive risk-adjusted returns for our investors. We analyze both the upside and downside risk in any potential transaction, and optimize the capital stack to blend optimal performance with risk mitigation.

Growth

Responsible growth is central to our ethos. We pursue properties in high appreciation locations and enhance value through strategic improvements, aiming for both immediate income and long-term gain. Our approach is guided by thorough ‘boots on the ground’ market analysis to spot trends and opportunities.

Timing

Brownstone Development Group exercised patience over the last four years by refraining from any new standalone storage or apartment acquisitions or developments. We are now, in 2024, optimistic about the resurgence of attractive investment opportunities, particularly regarding acquisitions. We build when cheaper to build. And we buy when cheaper to buy.

Diversification

Brownstone Development Group offers a broad spectrum of investment opportunities across various asset classes such as multi-family units, storage facilities, and land development or adaptive reuse. We provide investors with a diverse range of options tailored to individual preferences. Housing is one of the largest investable asset classes in the world, accounting for one-third of all consumer spending. Despite the size of the sector, housing is dramatically underrepresented in stock indexes. Investing directly in income-producing real estate offers retail investors a unique opportunity to diversify their portfolios beyond traditional stocks and bonds. Furthermore, by directly investing in real estate, investors gain more control over their real estate holdings, allowing for a tailored approach to leverage the long-term growth and resilience of the housing market, which is not fully captured in REITs or other indexes. Additionally, self-storage represents a compelling niche within the broader real estate sector, offering further diversification benefits. This sub-sector often exhibits counter-cyclical tendencies, maintaining demand even during economic downturns, as people and businesses look for storage solutions during times of transition. The relatively low overhead and maintenance costs associated with self-storage facilities also contribute to their attractiveness as an investment, potentially offering stable returns and high occupancy rates regardless of economic conditions. There is a good reason why storage REITs have outproduced all other CRE asset classes over the long run.

Submarket Selection

Brownstone Development Group avoids regions characterized by historically high crime rates and persistent bad debt issues. Considering the COVID-era eviction moratorium and its ongoing impacts, several properties are experiencing a temporary surge in accounts receivable, presenting potential opportunities. However, our strategy looks to explicitly exclude areas with a longstanding history of elevated crime rates and habitual evictions.

Committed to Patient and Disciplined Investing

Brownstone Development Group exercised patience from 2019-April 2024 by refraining from any new stand-alone storage, apartment acquisitions, or developments. Fundamentals of real restate became distorted by cheap money that would not last, so management refrained from new investments in this time frame. We are now optimistic about the resurgence of attractive investment opportunities as the market finds its equilibrium.

“Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it.”

Warren Buffett

Key Features

Discover what sets us apart and attracts investors.

investment in back office

Many real estate investment groups lack the capacity to invest in their company’s back-office operations. Our experience has shown that investing in the company’s infrastructure allows us to thoroughly analyze the economics of each acquisition, maintain a sharp focus on both short-term and long-term property management objectives, and swiftly respond to investor inquiries. Beyond our six-member investment committee, which reviews each potential investment, we have bolstered our capabilities in asset management, investor relations, marketing, and financial analysis to ensure seamless operations and avoid oversights.

cost segregation

Brownstone leverages cost segregation strategies to maximize investors’ savings by meticulously identifying and reclassifying property assets, significantly reducing taxable income on gains. This approach accelerates depreciation deductions, leading to substantial tax savings and enhancing the overall return on investment for our clients. For example, Specific components such as appliances, carpeting, and kitchen cabinets in each unit can be segregated from the building structure (27.5-year IRS schedule) and accelerate depreciation over a 5-year period.

Property tax appeals

Management will review each asset when tax bills are released by the prevailing municipality and will make a determination whether to appeal taxes.

aligned incentives

Brownstone does not need to place capital or transact like many operators of real estate. We are not driven by fees, nor do we need them to fund back-office operations. We are selective on the properties we intend to buy, and this ability to be patient allows us to wait for deals that fit our investment needs.

Risk Mitigation

Leverage

Each investment is assessed individually, and there is a strategic preference for lower leverage ratios to minimize risk. The expected leverage is projected to be 65%-75% Loan-to-Cost (LTC) range. In today’s capital market environment, it is imperative that deals are rigorously underwritten, ensuring they do not depend on the compression of interest rates and capitalization rates for their financial viability.

Alpha Investing (CAPM)

Brownstone calculates the “alpha” and ‘beta” using the CAPM method for each potential investment alongside traditional methods such as Discounted Cash Flow Analysis, Internal Rate of Return, and Cap Rate (or Interest Rate) sensitivity modeling. CAPM provides a method to assess the expected return on investment, accounting for market risks. By incorporating this analysis, Brownstone can ensure investments are adequately aligned for market/systematic risk. Additionally, the model can guide pricing strategies for acquisitions by aligning expected returns with market benchmarks, thus supporting informed investment decision-making and strategic portfolio management. While this method is more common in traditional finance, few real estate investment companies have taken the time to ensure their investments are properly risk-adjusted. An analysis of the downside is just as important as understanding the upside.

Exit Strategy

All investments are made with a five-year investment horizon and a clear and actionable exit strategy, underpinned by the historical performance of the relevant market and submarket.

For apartments, the back-end sale of the asset is a key component of IRR. Multifamily investments will have a defined and executable exit strategy that will be supported by market and submarket track records.

The key component of IRR for self-storage is focused on cash flows rather than back-end sale. We will closely monitor market trends and operational performance, recognizing that cash flows tend to be more stable and capital expenditures comparatively lower, leading to extended average holding durations.